Revenue Computation System

For Toll Plazas on Highways

Back in 2019, Being a Software major student, I identified a problem with our Highway tolling system. So I designed a system to tackle the problems. Proposed system was Revenue Computation System which helps us in toll tax collection online. Every toll booth at National Highways is accountable for its own tax with no tax corruption. Toll cashier’s job is to collect the cash identified by the wen application with the help of vehicle type recognition.

I parted as a System Designer. UX Engineer, Front-end Developer and Project manager.

Problem Statement

National Highway Authority in Pakistan generates its most revenue through national highways rather than motorways. In year 2018-2019, National Highways collected a total sum of 17 Billion rupees through toll plazas other than Build, Operate, and Transfer (BOT) funds. After all these funds, NHA is not being able to use its own resources for building highways and motorways. Grand Trunk road being the most used way transport around the country faces problems like insufficiency of dedicated road funds, corruption of road and toll taxes, and negligence of spending funds at the right places.

A mismanaged toll booth system is faced with problems such as unequal tax computations, cashier’s human error, identification of heavy-load vehicles, and applying incorrect tax according to a vehicle. Tax collection from each vehicle is difficult considering the huge number of vehicles passing through a few numbers of lanes only after clearance and toll tax corruption becomes easier when the toll booth requires to pass each vehicle as quickly as possible and without issuing any receipt of tax payment.

User Research

A glimpse of Pakistan’s Toll Plaza System

This happens quiet often- not even lying…

- Saad (A toll booth worker)

National Highway Authority in Pakistan generates its most revenue through national highways rather than motorways. In year 2018-2019, National Highways collected a total sum of Rs. 17 Billion rupees through toll plazas other than Build, Operate, and Transfer (BOT) funds. After all these funds, NHA is not being able to use its own resources for building highways and motorways. Grand Trunk road being the most used way transport around the country faces problems like insufficiency of dedicated road funds, corruption of road and toll taxes, and negligence of spending funds at the right places. A supplemented amount of tax is collected through toll tax, and this toll tax is enough to build and maintain national highways.

Therefore, Revenue Computation System acquires the data of each vehicle type by its license plate and apply tax, accordingly, making it easier for the cashier and identifying tax corruption. It also keeps a tax record of each vehicle that passes through toll booth for comparison of the deduced tax and provided tax. This system uses vehicle recognition technology that will help in reduction of tax corruption by keeping a log of each vehicle category for computations.

SCOPE

Our Solution

This project was developed to identify tax corruption as well as the efficiency of toll collection system. Each vehicle is identified by its structural measurements. This identified vehicle appears on cashier’s computer screen and cashier’s job is to collect the cash identified by the application in computer and enter the subsequent tax amount. A computed log is also generated for record. This log is sent to admin for evaluation, if the computations were not found equal and matching with projected tax then the toll booth is corrupt, thus necessary action is due. Consequently, each toll booth will be evaluated and no tax corruption would occur.

Categorizing the project in two

Use Cases

Admin Portal

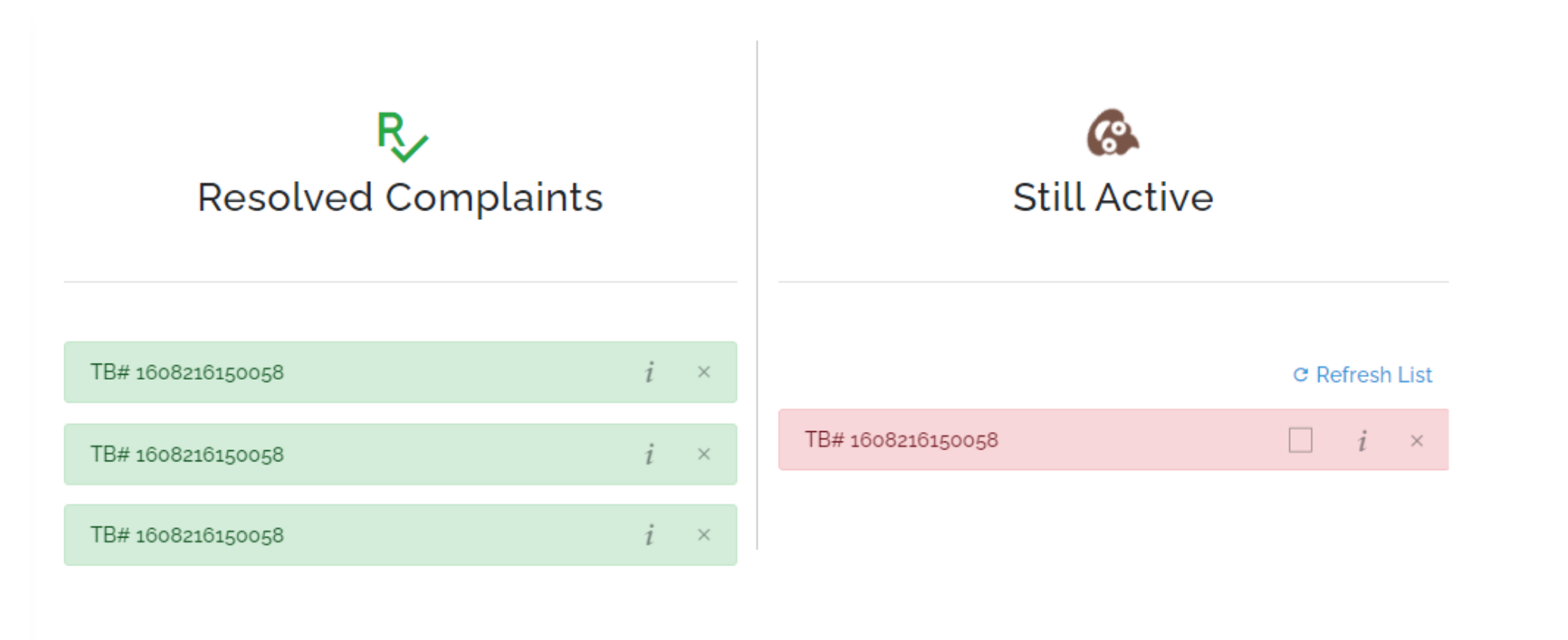

Admin can overview the daily total tax charges, manage complaints by the cashier, generate a tax record on need, notify discrepancy to the authorities, and manage a toll point account for a cashier.

Manage complaints.

Generate a tax record.

Notifying discrepancy

Create a toll point

Clear tax record

Update a toll point

Toll Booth Portal

The cashier uses web application at the toll booth, the application is built for user profiling, display of toll rate, and to alert the cashier for discrepancy. The cashier can use basic login and log-out functionalities according to his given shift in this web application.

Perform computation process

Display interface of toll rate

Sending data to database

Confirmation of tax collection

Alert admin and cashier

User Profiling: Profile of each tax cashier with login and adding profile functionalities by

the admin.

Let’s Come Up With Basic

User Sequences

User Flow

My developer side!

For the RVS project, I designed a robust MySQL database that served as the backbone for our system, ensuring efficient data management and retrieval. I began by conducting thorough requirements analysis to understand the data needs and workflows. This led to the creation of an optimized schema with well-defined tables, relationships, and indexing strategies to enhance performance. As a developer, I implemented complex SQL queries and stored procedures to handle intricate data operations, ensuring data integrity and security throughout. My dual role as both designer and developer allowed me to bridge the gap between database design and application functionality, resulting in a seamless integration that significantly boosted the overall efficiency and reliability of the RVS project.

FINAL OUTCOME!!

Conclusion

In conclusion, the project effectively addresses the issues of tax corruption and inefficiencies within the toll collection system on Pakistan’s national highways. By utilizing vehicle identification through structural measurements, the system ensures accurate toll collection and minimizes the risk of corruption. The generated logs provide transparency and allow for administrative oversight, ensuring that toll booths are held accountable. This approach not only enhances revenue collection but also contributes to the proper allocation of resources for the maintenance and development of the highways, ultimately supporting the National Highway Authority in better utilizing its funds.